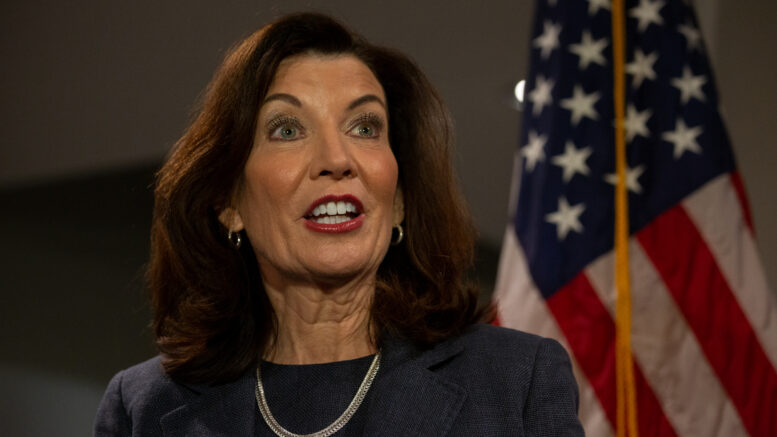

With less than two weeks to go until the state needs to have a budget in place for the next fiscal year, Gov. Kathy Hochul and Democrats in the legislature remain as much as $9 billion apart on how much Albany should spend.

To reach a compromise, they will have to balance three competing priorities: new infusions for COVID relief programs, increasing money for child and home health care, and putting aside money to prevent fiscal disaster when the next economic downturn comes.

Hochul’s $216 billion budget proposal would increase state spending by $10 billion. The Assembly’s budget proposal released this week sought an additional $5 billion. The state Senate wants as much as $9 billion more.

Fiscal experts are focused on the long-term picture. “The increase will create more risk that we will run into problems down the road,” said Peter Warren of the conservative-leaning Empire Center.

Progressive advocates emphasize the still-pressing need to recover from the damage inflicted by COVID as well as longstanding problems in the state.

“New York faces a tidal wave of evictions, and state leaders must prioritize keeping families in their homes,” said Judith Goldiner, who heads the civil law reform unit at The Legal Aid Society. “Also important is an increase in payments to home health aides, many of whom are Legal Aid clients or serve Legal Aid clients, and will be raised out of poverty.”

The governor will be under pressure to pass a budget on time as she runs for election hoping to cast herself as a moderate Democrat and skilled chief executive of the state. Assembly Speaker Carl Heastie and Senate Majority Leader Andrea Stewart-Cousins will have to find a way to deliver for the progressive wing of the party, which dominates both houses.

The state is required to adopt a budget by April 1, a deadline that was frequently missed — sometimes by months — until Andrew Cuomo became governor in 2011 and made reaching a deal with the legislature a priority. Usually the budget not only deals with revenues and spending but includes numerous other policy issues that get decided in the budget horse trading.

Two issues that have received a lot of attention — allowing restaurants to sell alcohol to go and extending mayoral control of the city’s schools — have already been dropped from the budget to be considered later in the session that ends in June.

Still, renewal of the city’s 421-a tax break remains possible as part of the budget. And it’s still possible that the governor’s proposal to modify recent bail reforms will become part of budget talks.

More Problems, More Money

When it comes to allocating available money, the governor and both houses are committed to multiple programs to deal with the consequences of the COVID shutdown and the city’s deep economic downturn.

Some of the possibilities on the table (or off it):

- Both the Assembly and the Senate have set aside about $1 billion for the state program to pay rental arrears for tenants hurt economically by COVID shutdowns and restrictions. The federal government gave New York an additional $119 million for the so-called ERAP program last week.

- Legal Aid and other groups working on housing issues are pushing a new program that boosts the amount of money available for rental vouchers by $250 million. They also are seeking $500 million for public housing, where many tenants have also fallen behind on rent.

- The Hochul budget’s $10 billion increase included big hikes for public higher education, K-12 education and health care. Both the Assembly and the Senate want to go further with a focus on home health care and child care.

- The Senate would add almost $1 billion to boost pay for home health care workers, with the Assembly setting a minimum wage for the industry at 150% of the broader minimum wage — which would bring it up to $22.50 an hour in the city. “New York faces the worst home care shortage in the nation, and this crisis has left tens of thousands of aging adults and disabled people without care and forced them into dangerous nursing homes,” said New York Caring Majority, a coalition created to support the increases.

- The Senate wants to add $2.2 billion to expand universal child care statewide to families making less than $140,000.

- None of the three budget decision-makers has proposed replenishing the Excluded Workers Fund, which provided $2.1 billion in aid to undocumented New Yorkers not eligible for federal relief programs. Immigrant advocacy groups are making a last-ditch plea for more funding but face steep odds.

While advocates say the money is vitally needed, fiscal experts warn that such proposals will become entitlements that may be too expensive in the future. “These are not federally funded and, if established, will quickly become a major drain on the operating budget,” said Kathy Wylde, president of the Partnership for New York City.

Meanwhile, business groups expressed disappointment that the legislature is only willing to spend $300 million or less to pay down the state’s enormous $9 billion debt to the federal government for unemployment insurance loans. “It’s a pittance given the size of the debt and the federal relief money available,” said Warren, of the Empire Center. New York will eventually have to sharply raise unemployment insurance taxes on companies to pay back the debt.

Saving for the Future

The legislature and the governor agreed last month that the state could expect $1 billion more in taxes than Hochul estimated in her original budget proposal.

Taxpayers will see some gains as a result: All sides appear to have agreed to Hochul’s proposal to provide $2.2 billion for property tax relief — which will arrive shortly before the November election — and $1.2 billion to speed up a middle-class income tax cut. But 29 states and the District of Columbia are enacting more significant tax reductions, according to the Tax Policy Center, using stronger than expected revenues and unspent federal aid money.

While the Senate did not specify where the money would come from for its budget additions, the Assembly intends to slash the $16 billion Hochul proposes to set aside to give the state a cushion for the next economic downturn.

Under Cuomo, New York’s reserves ranked 41st among the 50 states, according to an analysis by the Pew Charitable Trust. Hochul’s plan would squirrel away 15% of state operating expenses, or $19 billion, which would put it well above the national average.

Hochul’s proposal was made before inflation accelerated in the U.S. and the Russian invasion of the Ukraine increased market turbulence and economic uncertainty–all of which raises the risk that the state’s revenue projections for the next four years will be too optimistic.

“Policymakers should keep an eye on the years ahead when temporary federal funding will end and build up the state’s reserves, so we are better prepared for future emergencies or an economic downturn,” State Comptroller Tom DiNapoli warned in his review of Hochul’s budget proposal last month.

This article was originally posted on Coming State Budget Pits Progressive Programs Against Spending Caution

Be the first to comment on "Coming State Budget Pits Progressive Programs Against Spending Caution"